Some links on this page may contain affiliate links which means that, if you choose to make a purchase using the link, Agricfy.com may earn a small commission at no extra cost to you. For more information, go to our Affiliate Disclosure Page!

Introduction

As salary earners or even an entrepreneur, we are all looking for ways to improve our savings habits and beyond that double our investments.

The traditional way of saving and investing is fading away. In the 21st Century in which we are in, technology has sprung up some opportunities where we don’t have to worry about how to invest the spare money that we have.

If you are in Nigeria or even a Nigerian in the diaspora, we know that having your money lying fallow in the bank will only decrease the amount you saved, it will not increase it.

Why don’t you leverage technology by using digital investment platforms to increase your wealth? How? By saving with several online saving and investment platforms in Nigeria available for everyone to check out.

Some of these platforms are privately owned by individuals, while others are owned by popular banks in Nigeria.

In this article, I will be discussing different investment platforms in Nigeria that you can use to maximize your wealth.

Definition

Before going into the different investment platforms in Nigeria you can use, you need to know what savings and investments are.

What Is Savings?

Savings is putting aside a percentage or particular amount to be used in the nearest future. This amount can be saved in a bank, or kept in a place that can not be easily accessible.

According to Investopedia, Savings is the money a person has leftover when they subtract their consumer spending from their disposable income over a given period. Savings can be used to increase income through investing.

What Is Investment?

Investopedia defined investment as an asset or item acquired with the goal of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time. When an individual purchases a good as an investment, the intent is not to consume the good but rather to use it in the future to create wealth. An investment always concerns the outlay of some asset today—time, money, or effort—in hopes of a greater payoff in the future than what was originally put in.

Simply put, an investment is when you buy something (like land or a building) to tie down your money and this asset can be used to bring more recurring money over time.

Investment is different from savings in the sense that savings involve putting money away for further use, while investment is buying an asset with your money, and returns increases always.

In Nigeria where we are today, there are different online companies you can use to save and invest your money, and you will receive returns monthly, quarterly, or annually.

Online Investment Platforms In Nigeria

Whether you are making money every day, weekly, or monthly, there will always be bad days when things will not go the way they should go. When that happens and there is nothing to fall back to, you will get stranded and you might have to start from ground zero.

But if you have saved for the rainy days, no matter how bad things go, you will have something to fall back on.

1. Piggyvest

The first savings and investment platform in Nigeria is Piggyvest. Piggyvest started by being named Piggybank (popularly known as KOLO in Yoruba).

Piggyvest is the number one digital investment platform in Nigeria. It was founded on January 7, 2016, with the motive of helping people cultivate the habit of savings. It later introduced investment opportunities for people to better have the option of not just saving their money but also increasing their wealth by investing a portion of the money they have saved.

Piggyvest has 4 major plans that you can use to save your money.

- Core Savings

- Target Savings

- Safelock

- Investify

- Core Savings: This function aims to help people save either daily, weekly, or monthly. This feature also allows you to quicksave at any time of the day.

Aside from the quicksave feature, Core Savings allows you to set a specific time for the money to be automatically deducted. This feature is called Autosave.

Those that use the Core Savings function, get to have 10% returns on their investment yearly. This interest is paid monthly.

If you are using the Core Savings feature, you can withdraw your money every three months (quarterly) and also have the opportunity to set a day to withdraw your money charge-free.

If you wish to withdraw your money aside these 5 days set aside in a year (i.e. break your savings), you will be charged a 5% transaction fee. According to Piggyvest, this transaction charge is introduced to encourage discipline and help resist temptation.

- Target Savings: The second feature is target savings. It aims to help people save for a particular goal or project. You can come together as friends to use this feature to save together for a common goal. You get to earn an interest of 8% per annum using this feature.

- Safelock: This feature helps you put money aside and lock the fund for a particular time. This feature is good for anyone that is not so disciplined when it comes to savings and you feel like he/she will be tempted to withdraw the money.

One thing I like about this feature is that, unlike the core savings feature, once you lock your fund, you don’t have access to it until it reaches its maturity date. It doesn’t have any transaction charge or fee that will be used to break your savings.

The annual interest rate on this feature is 12.5% and is paid upfront.

- Investify: This Piggyvest feature helps savers to go a step further to invest some spare money without a hassle. You can choose from their various investment option to put your money into. With as low as N 5,000 ($13.12), you can invest in any opportunities ranging from Agriculture products (like cassava, Sweet Potato, Chicken, etc), to Treasury bills to Cryptocurrency.

You can get up to 25% returns on investment for 6 – 12 months.

Other Piggyvest features are Flex Naira and Flex Dollar

- Flex Naira is a feature that allows you to save money without having to worry about withdrawal dates or charges. According to Piggyvest, they say the Flex Naira was set up to handle life emergencies.

You get to earn up to 8% annual interest paid monthly. If you withdraw more than 3 times in a month from your flex naira, you will forfeit the interest due for that month.

- Flex Dollar is a feature that allows you to save your money in foreign currency (dollars, pounds, euros, etc). You earn an interest of 5% per annum (paid monthly).

Piggyvest has its office located in Victoria Island, Lagos.

By using Piggyvest, there are many ways you can save and invest your money and earn from it monthly.

You can get started by clicking on this link https://www.piggyvest.com/?newref=1&ref=1aeaa112cd

For more information on their product and services, you can contact them through this email contact@piggyvest.com

2. Cowrywise

Next on the list of digital investment platforms in Nigeria is Cowrywise. Cowrywise is another investment company that emerged as a way to help people with financial discipline. It was founded in 2017 by Razaq Ahmed and Edward Popoola.

They are seen as a competition to Piggyvest. They operate like Piggyvest but with a bit of change in their product (feature).

The Cowrywise platform has three categories which are Plan, Save, and Invest.

The Plan category helps you plan out how your money will be spent. It has a planning toolkit that helps you determine and plan your life.

The Save category is the major feature that Cowrywise started with. The Save feature helps you put aside some money for future use. Like Piggyvest, they have subcategories that can help determine how to save your money which are:

- Regular Savings: This subcategory helps you save money for a minimum period of 3 months.

- Life Goals: This Saves subcategory helps you save for long-term goals. These goals might include but are not limited to buying a car, building a house, a wedding project, and so on. The minimum saving period is 12 months (1 Year).

- Halal Savings: Halal Savings follows the Islamic banking model I.e. no interest. This subcategory is suitable for the Muslim faithful. According to Cowrywise, they say Halal Savings helps save money with or without automation, free of riba, and absolutely interest-free.

- Savings Circles: This subcategory helps you save a particular goal with your friends. Saving Circles is like the Target Saving of Piggyvest.

The Invest category helps you invest in Mutual funds through Cowrywise. According to Cowrywise, they have partnered with companies like Afrinvest, United Capital, Meristem, and so on.

Their interest rate ranges from 10 % per annum.

You can get started by clicking on this link – https://get.cowrywise.com/r/DanieTS1

For more information on their product and services, you can contact them through this email support@cowrywise.com

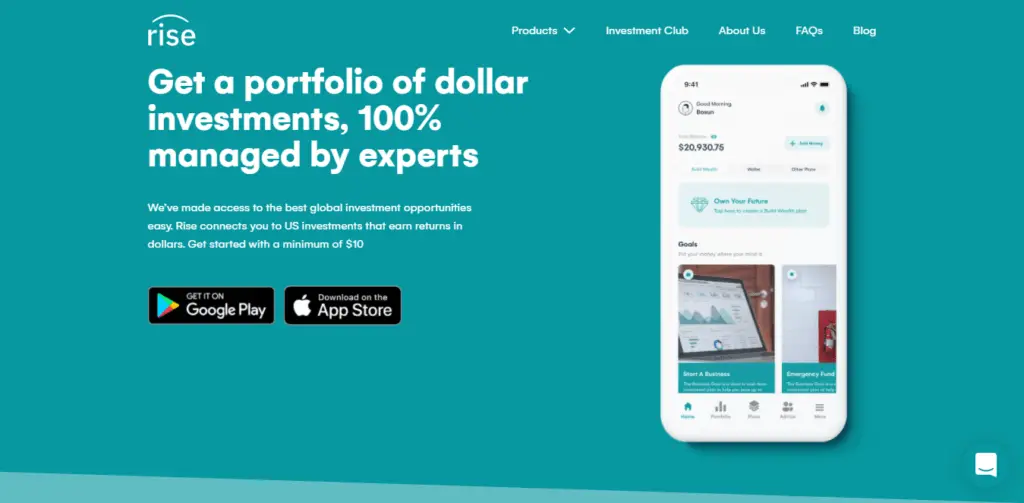

3. Risevest

The next digital investment platform in Nigeria is Risevest. If you are a Nigerian that has been wanting to invest abroad, then this platform is what you can use. Risevest is a portfolio investment platform that helps you invest in dollars from Nigeria.

It was founded in 2019 by Eke Urum (Founder & CEO), Bosun Olanrewaju (Co-founder & CTO), and Tony Odiba (Co-founder & Data Analytics). They have their office located in Yaba, Lagos, Nigeria

Risevest has three categories of products that you can invest in. They are:

- Stocks: This category helps you invest in the US stock market. A few of the US companies that you can invest in are Coca-Cola, Alibaba, Google, Apple, Tesla, etc. This category is tagged as a ‘high-risk’ investment plan.

This category has an annual return on investment of 14%.

If you are a risk taker, you can jump on it, as the saying “The higher the risk, the juicer the returns become”.

- Real Estates: The second category is Real Estate. As you know that one of the fast-growing industries that one can invest in is real estate. This investment is tagged by Risevest as “medium-risk”. The returns rate for this investment category is 15% per annum.

- Fixed Income: The last Risevest product category is Fixed Income. This product is a low-risk investment portfolio. You don’t need to worry about losing your money if you invest in this product. According to Risevest, they say Fixed Income is perfect for anyone who wants to protect their money in a secure, appreciating currency.

The return on investment for this product is 10%.

One amazing thing about investing in Risevest is you can buy any of the above products for as low as $10 (N 4,500).

You can choose from either the Stocks, Real Estate, or Fixed Income investment portfolio to start things out and give it a try.

Risevest also has a community for people who wants to build wealth. It is specifically tailored to people who want to save for retirement.

You can get started by clicking on this link – https://m.rise.capital/qJxWkfeg4NCeqNne8 (Referral code – QS7BCLDO)

For more information on their product and services, you can contact them through this email hello@rise.capital

4. Investment One

Another online investment platform in Nigeria is Investment One. Investment One is a subsidiary of the popular Nigeria Bank GT Bank. It was founded in 2007 and incorporated in 2008 as a financial service designed to help people invest more as they save.

This platform offers financial services as well as Capital Management options. Their financial services include:

- Funds Management: This helps you manage your mutual funds and all investment schemes. It is easy to sign up for this investment opportunity. The most common mutual fund opportunity you can jump on is our ABACUS Money Market fund, Vantage Guaranteed Income fund, Vantage Equity Income fund, Vantage Balanced fund, and Vantage Dollar fund.

The returns on these investments go as low as 2.42% to like 14.12% per annum.

- Pension: This opportunity helps pensioners manage their retirement. According to them, the Pension Manager was formerly known as Royal Trust Pension Fund Administrator Limited but has been recapitalized and renamed GTB-AM Pensions Limited in 2012.

As of today, the company is called Investment One Pension Managers Limited. You can fund your pension plan through them.

- Stockbroking: Investment One Stockbrokers Int’l Limited is licensed as a broker/dealer to help to intend investors that want to go into the stock market. They are registered with the National Association of Securities Dealers Over-The-Counter.

- Trust Services: The Investment One Trust Service allows assets to be easily transferred to beneficiaries. They offer the following Trust Services: Corporate Trust, Public Trust, Estate Planning, and Private Trusts.

The Capital Management opportunities include:

- Finance: This subcategory help individual, and SMEs work towards achieving their financial and business goals. The aspect of Investment One is registered as Orange One Finance Limited on December 7, 2016. The products that are included under the Finance Capital Management opportunities are Personal loans, Asset Finance, Working Capital Loans, invoice Discounting facilities, Local Purchase Order (LPO) financing, and contract finance.

- Investment Banking: This product allows clients/customers to get structured investment banking transactions in the Nigerian financial market. This product applies to private and public companies, governments, statutory corporations, and multinational financial institutions.

- Private Banking: According to Investment One, this product is targeted toward affluent individuals, families, and corporate clients.

- Venture Capital: This product focuses on SMEs (Small And Medium Scale Enterprises) and provides essential business support to investee companies from the investment date to the financial exit date.

Visit the website https://www.investment-one.com/ to get started

For more information on their product and services, you can contact them through this email enquiries@investment-one.com

5. Payday Investor

Next on the investment platforms in Nigeria that you can use to increase your wealth is Payday Investor. Payday Investor is a subsidiary of the Asset & Resource Management Holding Company (ARM).

If you are skeptical about saving and investing online and you don’t want to lose money, you can get started on Payday Investor for as low as N1,000.

Payday Investor has three categories of products that you can choose from if you want to invest in Payday investor. They are:

- Goal-Based Investment: This plan is targeted at automating your investments towards your financial goals.

- Group Goals: Just like the target savings on Piggyvest and Saving Circles on Cowrywise, the Group Goals are targeted at helping people save towards a particular goal. So you can come together with your partner, squad, or community to save for a reason.

- One-Time Investment: The One-Time Investment plan is like a fixed deposit thing where you put a large sum of money into an investment for a long time.

To start investing on Payday Investor, visit their website https://paydayinvestor.ng/

For more information on their product and services, you can contact them through this email hello@paydayinvestor.ng

6. I-Invest

The next digital investment platform is I-invest. I-invest is founded by Parthian Partners Limited and is regulated by the Security and Exchange Commission (SEC). If you want to invest in Treasury bills, I-invest is one platform that you can give a try.

If you decide to use the I-invest platform, there are three (3) opportunities that you can choose from, which are:

- Treasury Bills: These are short-term investments that you can venture into. They are debt instruments issued by the Federal Government of Nigeria through the Central Bank.

- Eurobonds: These are investments issued in a currency that is not of the issuer’s home country. Eurobonds are issued by the Federal Government, Companies, and International Organizations.

- Equities: This is an amount invested in a company by purchasing shares of that company in the stock market. These stocks are publicly listed on the Nigerian Stock Exchange Market.

With N 100,000 in your pocket, you can start investing with I-invest.

To start investing on Payday Investor, visit their website https://i-investng.com/

For more information on their product and services, you can contact them through this email info@i-investng.com

7. Trove

Another digital investment platform in Nigeria is Trove. Trove is a platform that is dedicated to investing in stocks, bonds, ETFs, and so on. According to them, they implore you to “become a global investor with the tap of a button”. It was founded in 2018 by Oluwatomi Solanke (who is the co-founder & CEO).

Trove throws out a disclaimer on their platform that everyone should be aware of before investing and that is “Trove is a technology platform, not a registered broker-dealer or investment adviser. Trove does not offer its own recommendations for any security or provide its own research to any user regarding any security transaction or order.

Please note, investing involves risk and investments may lose value. Past performance does not guarantee future results.”

If you want a broker for further guidance before investing in any stock market, they have put up a list of companies that will help with that.

With as low as $10 and/or N 1,000, you can start investing in Trove. Their portfolio is managed by ARM Investment Managers.

Getting started to invest in the Trove platform is as easy as ABC but first, you have to give out some vital information to register on the platform. Although one of the set back of registering on the platform is people’s complaints about the sensitivity of the information provided when getting started.

Trove has come out to defend this that it was necessary to provide information like Bank Verification Number (BVN) which was a directive by the Security and Exchange Commission and Central Bank of Nigeria in a way to reduce fraud and money laundering.

On Trove, you can invest in companies like Netflix, Facebook, Dangote, Apple, Uber, etc.

To start investing in Trove, visit their website https://www.troveapp.co/. You can download their mobile app through Google Play Store and Apple store so you can invest on the go and anywhere you are.

For more information on their product and services, you can contact them through this email hello@troveapp.co

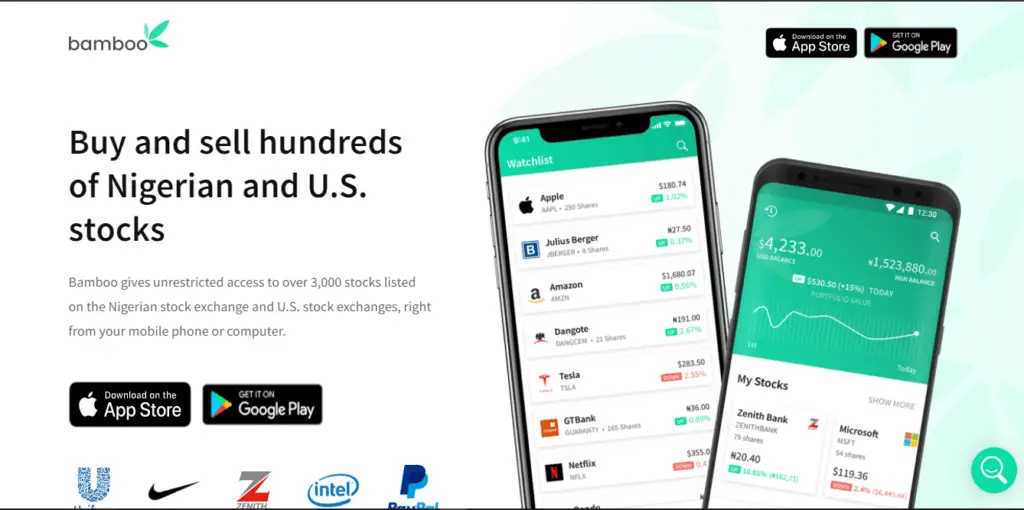

8. Bamboo

The emergence and eagerness of people to invest in foreign companies have birthed so many digital investment platforms that provide such opportunities. Bamboo was not left out in the movement to help Nigerians invest in US companies and dollars.

Bamboo just like Trove and Risevest is another investment platform that you can use to buy and sell stocks in Nigeria and the US. Bamboo was founded in 2019 by Richmond Bassey and Yanmo Omorogbe.

Since their emergence, they have raised over $300k in funds from 7 known investors. For detailed information on this funding, you can check HERE.

Some of the most popular companies you can invest in through Bamboo are GT Bank, Tesla, Google, Unilever, Zenith, Intel, Paypal, Apple, etc. With a minimum amount of $20, you can get started on the Bamboo platform.

To start investing on the Trove platform, visit their website https://investbamboo.com/. You can download their mobile app through Google Play Store and Apple store so you can invest on the go and anywhere you are.

For more information on their product and services, you can contact them through this email support@investbamboo.com

9. Wealth.ng

Another digital investment platform in Nigeria is Wealth.ng. Wealth.ng is a mobile platform that allows you to invest in opportunities like fixed income, real estate, agriculture, and so on. It was founded in 2019 by WealthTech Limited, an affiliate of Sankore Securities.

Using the Wealth.ng platform, you can gift your loved ones (partners, kids, friends, etc) any investment on the platform. What does this mean? You will buy a stock or shares from any company listed on their platform in the name of your partner, family, or friends.

Products that you can choose from on the Wealth.ng platform are:

- Fixed Income: This is fixed security that you will receive interest on every year. It is a low-risk investment opportunity that you can explore. Under the fixed-income product, you can invest in either the treasury bill or invest in Bonds. With as low as N 10,000, you can start investing in Treasury bills while with $ 500, you can invest in Bonds.

You can get as high as 13% in returns if you invest in this opportunity.

- Stocks: This product is for anyone that wants to invest in stocks. Unlike the Fixed Income opportunity, this product is risky and before investing, you should make your findings and see that you are comfortable with the investment.

You can either invest in local stock or foreign stock. Some of the companies you can invest in are Google, Microsoft, Wema, Transcorp, etc.

- Agriculture: Almost everyone knows that agriculture is the future. A lot of you want to start an agribusiness but you are scared of the risk involved. With the advent of technology, you can now use companies like Wealth.ng to invest and make money from agriculture without having to worry about your money going down the drain. Investing in agriculture through Wealth.ng, you can earn as high as 22% in returns.

Some of the agricultural products you can put your money into through the Wealth.ng platform are Cocoa, Maize, Sorghum, and so on.

- Real Estate: Another gold opportunity is real estate. Real Estate just like agriculture is another opportunity that will boom in the future. Investing in real estate by yourself will cost you lost a lot of money. But with Wealth.ng, with as low as N 10,000, you can invest in real estate and get up to 18.7% in returns in a year.

To start investing on the Trove platform, visit their website https://wealth.ng/wealth/intro. You can download their mobile app through Google Play Store and Apple store so you can invest on the go and anywhere you are.

For more information on their product and services, you can contact them through this email hello@wealth.ng.

Conclusion

There are different opportunities you can jump on among the platforms that were mentioned. If you are someone that wants to increase your wealth through investment, then you can try any of the digital investment platforms in Nigeria.

Savings is good, and investing is better. If you are not a risk-taker, you can start small (with something that you know if you lose, you won’t be affected much), and increase the investment threshold over time. Before investing in any of these platforms, it is always good to do some background checks.

Although the platforms mentioned in this article are regulated by the Security And Exchange Commission and other financial regulators in Nigeria, if you are not a finance person, employ the service of an expert to put you through the terms and services and other risks that could be involved in investing on any of the platforms.

If you want an all-agricultural investment platform, you can check the article I wrote on the top 7 agritech companies in Nigeria.

Do you find value in this article, do well to share around.

[…] I have an article on different savings and investments platforms that you can consider looking at. You should check the article HERE. […]